Key channels VCC Live supports

Features to boost outbound activities

Fueling your outbound sales

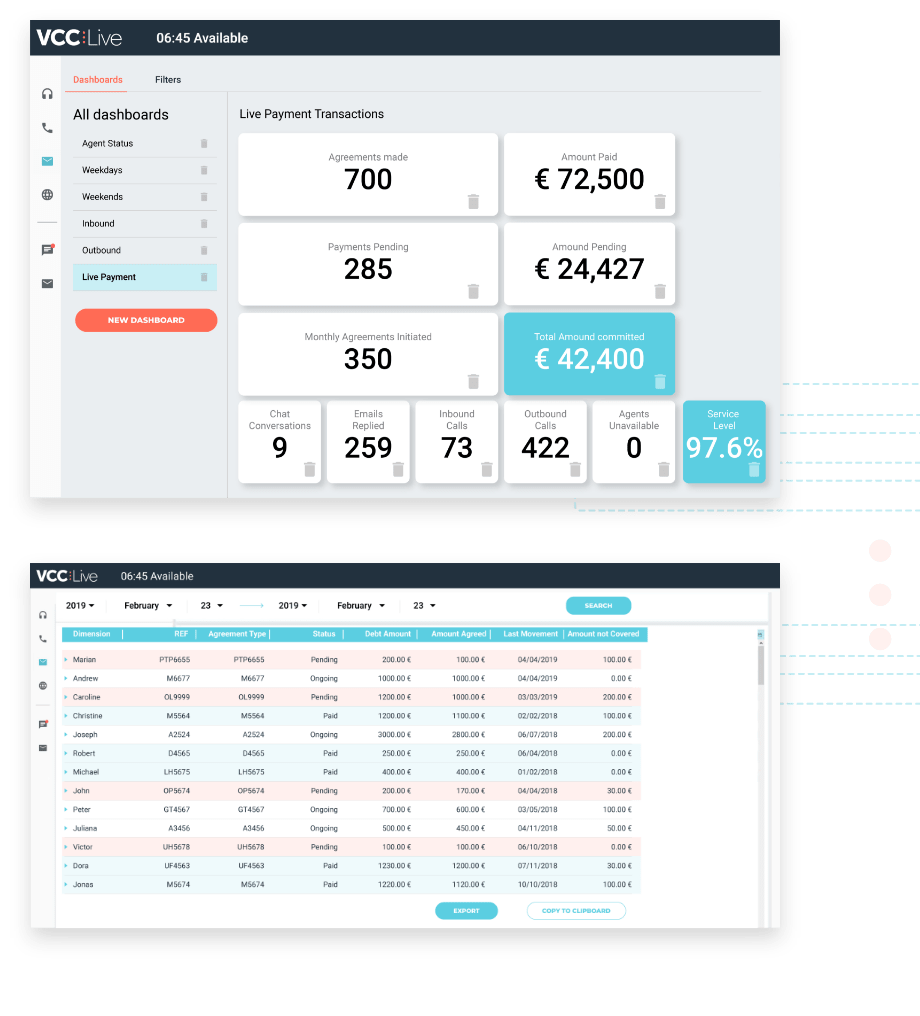

VCC live for inbound contact centers

Transforming customer service for tbi bank

Selected integrations for VCC Live users

Handle calls without leaving Salesforce