These days businesses provide their customers with the option of purchasing their services worldwide with just a single click, but ensuring that customers pay on time seems to be an uphill battle.

As a result, however, cross-border debt is also on the increase. And what businesses often forget is that international debt collection is a complex process that differs from country to country.

Collecting international debt is no easy task, so it’s essential to try and rely on a number of factors that will help make your procedures easier.

In this article, using my experience of working with clients who have their debt collection operations in a number of countries, I’ll show you what the main challenges of international debt collection are, and what techniques you can introduce to make your processes easier. So, here we go with the Good, the Bad and the Ugly of international debt collection!

What are the main challenges of international debt collection?

There’s no doubt that collecting outstanding debt is a real pain in the neck – especially if you need to collect cross-border debts from foreign customers located around the world.

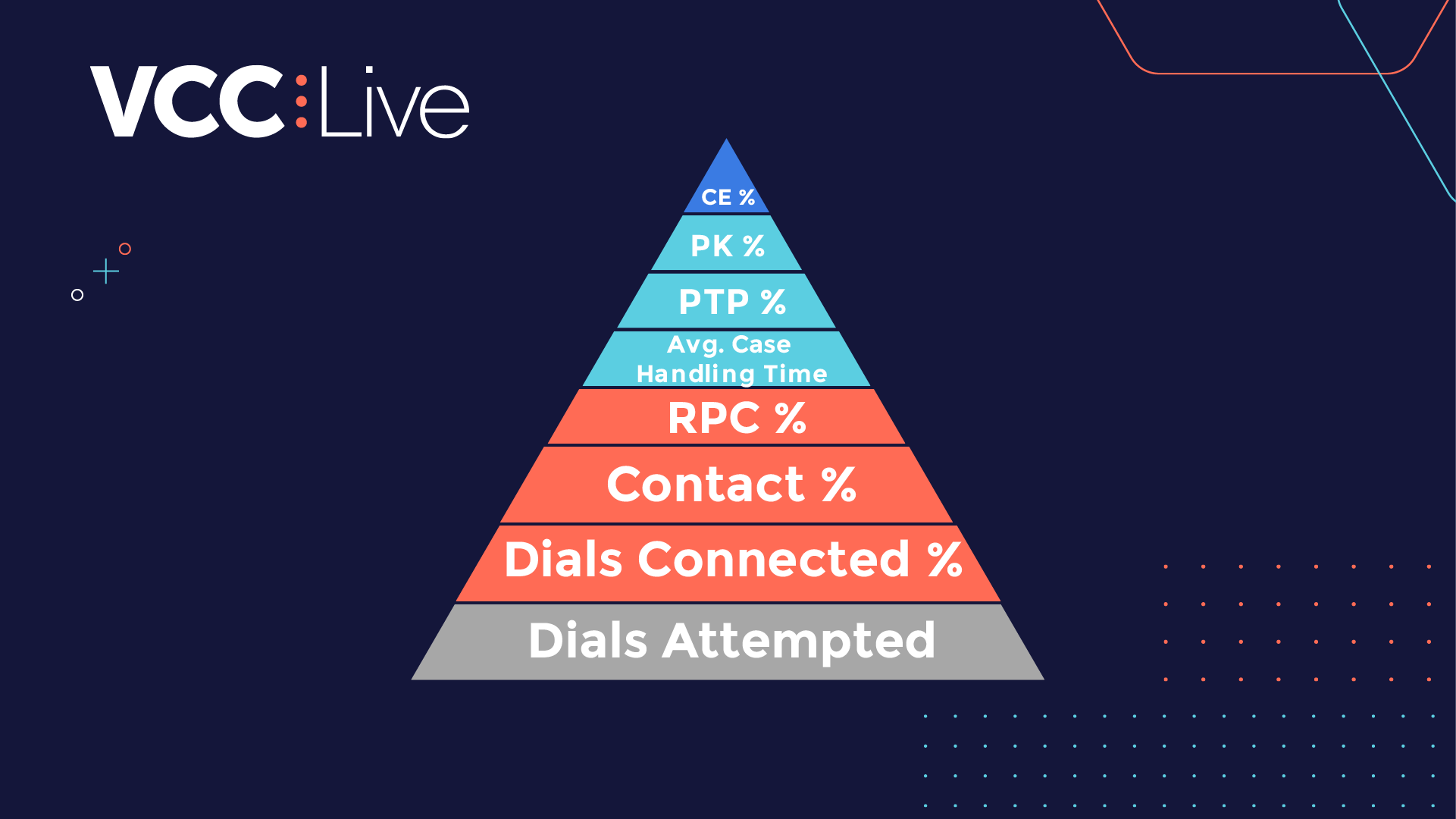

Considering some of our clients dealing with debt collection processes in more than 5 countries, one of the main challenges of international debt collection is definitely the ability to measure and compare the performance of debt collection between particular countries.

In fact, the methods of collecting debt, rate of willingness to pay, supported payment options, salary ranges and regulations vary from country to country, making it a very challenging job to measure whether a company’s debt collection operations are actually bringing in profit or instead making additional losses.

For example, in Hungary and Poland 40% of outstanding debts are paid over the phone, while in other European countries this method is rarely used. Furthermore, in certain countries debt collectors utilize SMS messages in order to notify debtors of their outstanding debts, while in other countries SMS is not considered an official notification.

Another major international debt collection challenge is that debt recovery process rules are regulated at a national level, and companies need to be aware of the different country-specific rules and regulations.

For instance, in most countries, it is prohibited by law to pay outstanding debts by credit card as it means transferring debts from one bank to another. On the other hand, in other countries settling debts by credit card is allowed by law (although it is not recommended).

As if that were not enough, courts also operate differently in different countries, so when companies have no choice but to take a debtor to court they may face significant obstacles depending on the country’s individual regulations.

In Australia, for example, courts refuse to take action on outstanding debts that are older than six years. However, in Hungary, this limit can be five, three or even one year, depending on the type of outstanding debt.

In order to reduce the impact of the above-mentioned challenges, companies tend to carry out their international debt collection processes from one central point. In other words, they operate their debt collection processes in, let’s say, 5 countries from one premises.

In such cases, having debt collection agents who speak the language of the debtors well enough to be able to deal with financial and legal terminology is of the utmost importance. And of course, finding and hiring such a workforce is another great challenge for companies that cope with international debt collection, especially if the languages in question are not widely used.

Finally, if your company has debtors who are located in several continents, different time zones will also make your processes more complicated. Handling negotiations across a number of time zones and reaching a customer on the phone who is located on the other side of the globe can easily turn your processes into a never-ending nightmare.

As such, if your business wants to collect debts from customers based around the world, then you’ll certainly need to rely on debt collection agents who will also be available outside regular business hours.

Best practices that make international debt collection easier

I could certainly go on with my list of further challenges, but let’s instead look at some best practices that will definitely allow you to improve your international debt collection processes.

So, here are my top tips to turn your debt collection nightmare into a profitable business:

1. As we already discussed, finding agents with the appropriate language skills is not an easy task at all. Furthermore, there’s no doubt that being a debt collection agent is not on the top of the list of employees’ dream jobs.

These days, companies all around the world struggle with labor shortages, so you’ll really need to go the extra mile in order to lure the best-suited debt collectors to your team. And although it may seem a tricky task, with some smart HR tricks even debt collector jobs can be made attractive to employees.

For instance, it’s a great idea to set up your debt collection hub in an area that is considered relatively popular among job seekers. By outsourcing your operations to, let’s say, a Mediterranean country and covering the costs of relocation, chances are you’ll be able to attract skilled foreign talent to your debt collection team, with the subsequent benefit they bring to your processes.

2. Furthermore, in order to overcome the difficulties caused by different time zones, make sure to target the newest labor market members, namely Gen Z, and attract them to your team with special offers tailored to their needs. If you’re interested in finding out how to keep the newest generation motivated in the workplace, make sure to check out our article on it.

3. Technology can also play its part. Solutions, such as setting time zones in your IVR technology, as well as the close monitoring of domestic and international KPIs can also be a great help in making your international debt collection easier.

4. Finally, when it comes to debt collection, it is essential to find the balance between the time invested in pursuing outstanding debt and the actual amount of debt that can potentially be collected. As you all know, over time, it’s simply not worth continuing to endlessly chase debt, otherwise you’ll easily end up with extra costs.

There is, however, a groundbreaking technology solution that allows you to speed up your international debt collection processes. Real-time payment technology allows debt collection agents to initiate payment processes with customers during phone conversations regarding their outstanding debt. Thus, agents can combine two debt collection phases into one. With real-time payment technology, collecting debts has never been so easy!

International debt collection requires country-specific knowledge, thorough planning and the willingness to always look for better ideas to ease up your processes. Feel free to follow my tips and probably you’ll too be able to improve your international debt collection processes.